Intel is actively pushing forward with its next-generation chip manufacturing process, aiming to regain independence in its semiconductor development and become a more attractive option for major tech players. According to a report by Korean outlet Chosunbiz, industry giants like Nvidia, Microsoft, and Google are already in talks with Intel about potentially adopting its upcoming 18A (angstrom-class) process for their future hardware.

This shift in interest reportedly gained momentum after a leadership change at Intel—Pat Gelsinger stepped down in December and was succeeded by Lip-Bu Tan in March. Under Tan’s guidance, Intel’s Foundry Services division is reportedly taking a more aggressive and strategic approach to win over new clients.

One major factor behind this possible pivot to Intel is TSMC’s overbooked production lines. As the world’s largest chip manufacturer, TSMC is often stretched thin, juggling orders from Apple, AMD, and many others. Additionally, geopolitical risks—such as U.S. tariffs initiated under the Trump administration and the precarious nature of Taiwan’s “silicon shield” strategy—have made companies wary of relying too heavily on TSMC.

In this context, Intel’s 18A process presents itself as a promising alternative, especially as the company races to regain relevance in the foundry space. If these talks materialize into deals, it could mark a major turning point not just for Intel but for the broader semiconductor industry.

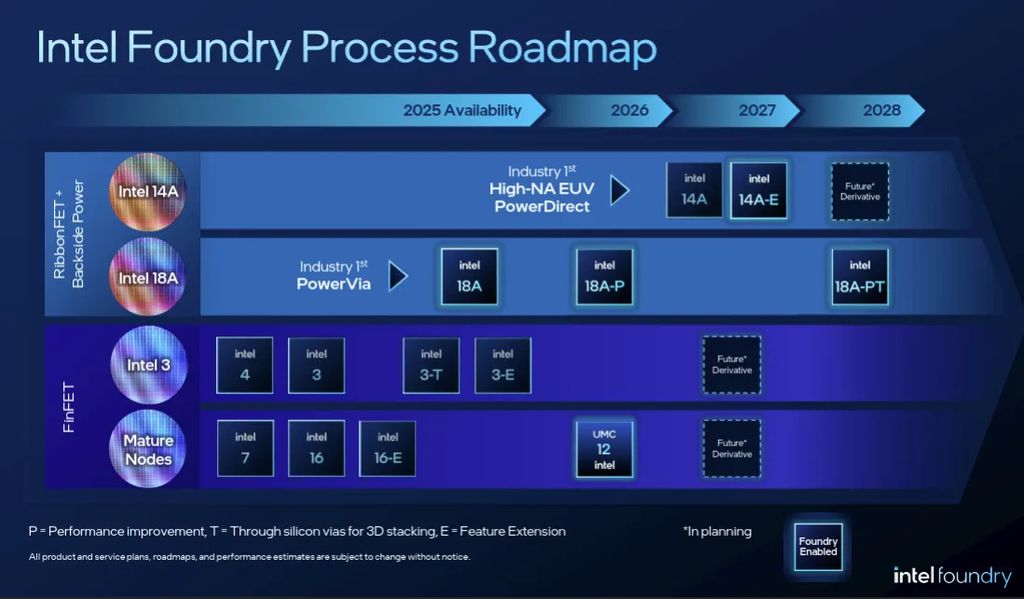

Expectation with Intel 18a

Intel’s upcoming 18A lithography marks a critical milestone in the company’s roadmap, both technologically and strategically. It’s designed to go head-to-head with TSMC’s 2nm (N2) process, a direct challenge to the current industry leader in advanced chip manufacturing.

The first processors built using 18A will be the Panther Lake chips for mobile devices, now expected to arrive in early 2026, following a delay from the original 2025 target. Despite the setback, Intel reports that development is progressing well, with test chips already running in labs.

One of the standout promises of 18A is its SRAM density—Intel claims it will match the levels that TSMC aims to deliver with its 2nm nodes. This is a significant achievement, as SRAM is typically a bottleneck in achieving size and power improvements at smaller geometries.

But beyond the technical metrics, 18A is a strategic pivot. Intel wants to:

- Reduce its dependency on TSMC, which has historically handled much of the high-end chip production for U.S. firms.

- Strengthen its Intel Foundry Services (IFS) unit by offering a viable domestic manufacturing option to major American tech companies like Microsoft, Nvidia, and Google.

- Align with U.S. geopolitical priorities, especially amid the trade tensions with China and concerns about overreliance on Taiwanese production.

If successful, 18A could position Intel not only as a top-tier chip designer again, but also as a serious global foundry competitor in a landscape increasingly shaped by political and economic uncertainty.