According to supply chain reports, Intel is expected to raise the prices of its Raptor Lake processors during the fourth quarter of 2025 (October–December). Chips currently priced around $150–$160 could see an increase of about $20, marking a jump of more than 10%.

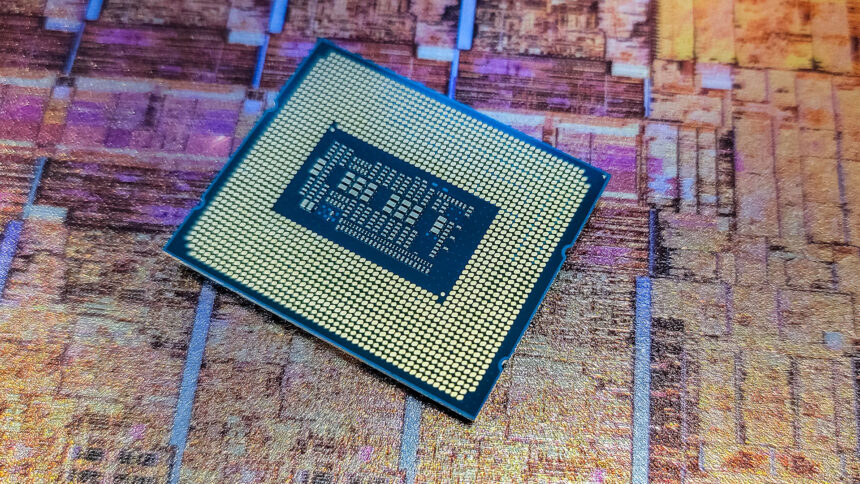

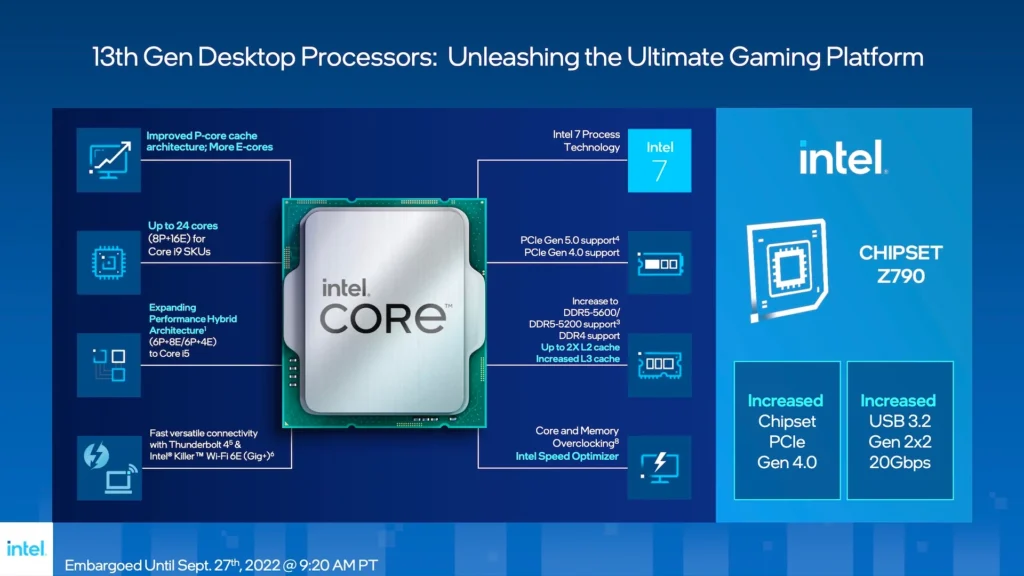

Interestingly, the price adjustment doesn’t target Intel’s latest Lunar Lake lineup, but rather Raptor Lake, which originally launched back in 2022. Rumors of supply shortages surrounding Raptor Lake have persisted since mid-2025, and availability remains tight.

When asked for comment, Intel’s PR team responded only with: “We cannot comment at this time.”

Why Raise Prices on Older CPUs?

Industry insiders believe the move is tied to the sluggish adoption of AI PCs. Despite the marketing push around “AI PCs” (or Copilot+ PCs, as Microsoft brands them), consumer demand hasn’t taken off as expected. Many point to the lack of a true “killer app” for on-device NPUs (neural processing units). For most buyers, price still matters more than AI features.

Because Raptor Lake CPUs are cheaper than Lunar Lake, they’ve become the preferred choice for OEMs and laptop makers looking to keep costs down. Ironically, the older chips are now selling better than Intel’s latest generation, which has fueled shortages and, reportedly, this price hike.

Reading Between the Lines

The DigiTimes report suggests the pricing conversation mainly revolves around mobile and laptop CPUs rather than desktops. The logic seems straightforward: with Lunar Lake sales underperforming, Intel is capitalizing on the strong demand for Raptor Lake and limited stock to adjust prices upward.

Still, these are supply chain claims, not an official stance from Intel. The company has neither confirmed nor denied the reports.

The supposed price adjustment highlights a larger issue: consumers remain unconvinced by AI PC marketing. Unless a must-have AI-driven feature arrives for Windows 11, many buyers will simply choose the cheaper option without an NPU.

For now, whether Intel will officially increase Raptor Lake pricing remains uncertain. But if supply remains tight and Lunar Lake continues to underperform, OEMs and end-users may soon feel the pinch.