South Korea’s SK Hynix reported its strongest quarterly results to date on Wednesday, driven by surging demand for high-bandwidth memory (HBM) chips used in AI data centres. The company’s revenue and profit both soared to record highs, underscoring its leadership in the rapidly expanding AI semiconductor market.

For the third quarter, SK Hynix posted revenue of 24.45 trillion won ($17.13 billion), just below analyst expectations of 24.73 trillion won, according to LSEG SmartEstimates. Operating profit came in at 11.38 trillion won, nearly matching the consensus of 11.39 trillion won.

Revenue jumped 39% year-over-year, while operating profit surged 62% over the same period. On a quarterly basis, revenue climbed 10%, and operating profit increased 24%, marking the first time the company’s quarterly operating profit exceeded 10 trillion won.

Following the announcement, SK Hynix shares rose nearly 5% in Seoul, extending the stock’s 210% rally in 2025.

AI Demand Drives Growth

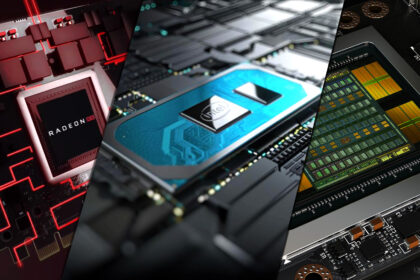

As a key supplier of memory chips for Nvidia’s AI processors, SK Hynix has benefited from explosive demand in the AI sector. Its HBM chips, which enable faster data transfer between memory and processors, are essential components in the high-performance servers that power generative AI applications like ChatGPT and Google Gemini.

“With demand across the memory segment surging as customers expand AI infrastructure, SK Hynix once again achieved record-breaking performance thanks to strong sales of high-value products,” the company said in its earnings statement.

Next-Generation HBM on the Way

The company confirmed it will begin supplying its next-generation HBM4 chips this quarter, following negotiations with major customers. HBM4 represents the sixth generation of the technology, promising higher bandwidth and improved energy efficiency.

An SK Hynix executive said during the earnings call that HBM products have been sold out since 2023, with supply expected to remain tight until at least 2027 as production ramps up.

SK Hynix currently holds the largest share of the global HBM market, estimated at 64% as of the second quarter, according to Counterpoint Research. The firm also commands 38% of the global DRAM market, extending its lead over Samsung, which it overtook earlier this year.

Competitors Samsung Electronics and Micron Technology are racing to close the gap. Samsung recently passed Nvidia’s qualification tests for its own HBM chips, while Micron has already begun supplying HBM products to Nvidia.

“With AI driving a new era of computing, memory demand has entered a new paradigm,” said Kim Woohyun, Chief Financial Officer of SK Hynix. “We plan to reinforce our leadership in AI memory by delivering advanced, market-leading products backed by differentiated technology.”

Industry analysts expect the HBM market to continue its rapid expansion, reaching roughly $43 billion by 2027.

MS Hwang, research director at Counterpoint, noted that SK Hynix’s long-term profitability will depend on maintaining its technological advantage.

Ray Wang, semiconductor analyst at Futurum Group, echoed that view:

“SK Hynix is likely to sustain around 60% global market share in HBM through next year, supported by strong relationships with key customers like Nvidia, Google, and other AI leaders.”

With its next-generation HBM chips on the horizon and capacity expansion planned for 2026, SK Hynix is positioning itself at the heart of the AI hardware revolution.