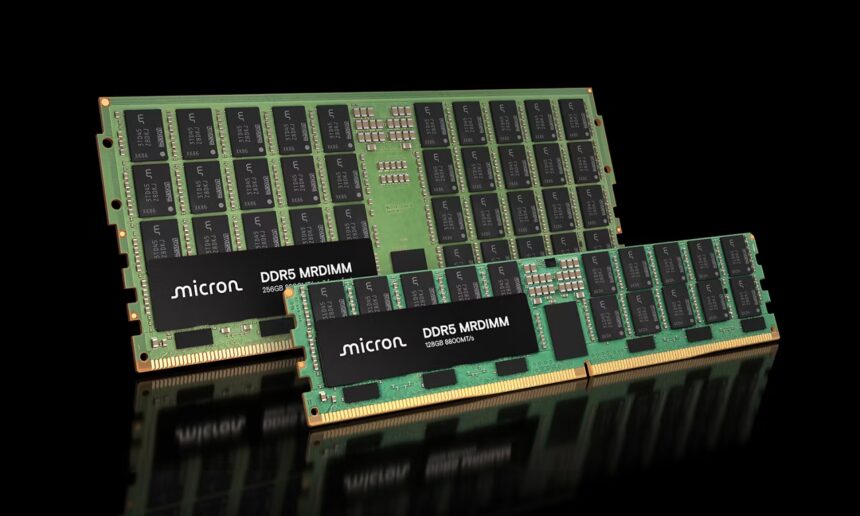

Amid a prolonged and disruptive global memory shortage, new data from Germany suggests that DDR5 RAM prices may be entering a period of temporary stability. According to a recent analysis published by 3DCenter.org, DDR5 pricing in the German market has effectively plateaued, marking a notable slowdown after months of steep increases.

The increase in DDR5 prices at German retailers has come to an complete halt in recent days. Although many prices were still fluctuating, there was only an average price increase of +0.1% compared to mid-January.https://t.co/cVLGc32iwW pic.twitter.com/lWipvv4pOX

— 3DCenter.org (@3DCenter_org) February 2, 2026

The report indicates that, based on price tracking across 20 different DDR5 memory kits, average prices rose by just 0.1% between mid-January and the end of the month. While this marginal change does not signal a return to normal pricing levels—current costs remain historically high—it does represent a pause in an aggressive upward trend.

Consistent Signals Across Markets

This development aligns with recent findings from PCParkPicker, which showed a similar leveling off in memory prices in the United States. In that dataset, both DDR4 and DDR5 pricing curves began to flatten after months of continuous increases, though higher-speed DDR5 kits were still seeing some upward movement at the time.

The German data, however, offers a more localized snapshot. 3DCenter’s analysis draws from pricing information on Geizhals, one of the region’s most widely used comparison platforms. The cheapest available listings on Geizhals show virtually no price increase over the past two weeks, suggesting that immediate upward pressure on DDR5 pricing has eased—at least for now.

Mixed Movements Within the DDR5 Segment

Despite the overall stabilization, price behavior varies significantly by capacity and speed. Some popular kits continue to fluctuate, particularly models in high demand. At the same time, a handful of configurations have actually seen meaningful price reductions.

The most notable drop was observed in 64 GB (2×32 GB) DDR5-6000 kits, which fell by approximately 15% compared to early January. Average pricing for these kits declined from around €699 to €596, offering a rare example of relief in the current market.

That optimism is tempered by increases elsewhere. High-capacity 96 GB (2×48 GB) DDR5-6400 kits recorded a 17% price increase over the same period. Similarly, 32 GB (2×16 GB) DDR5-6000 CL28 memory rose by roughly 11%, underscoring the uneven pricing landscape.

The “Sweet Spot” Remains Historically Expensive

For most current-generation PC builds, 32 GB of DDR5-6000 memory is widely regarded as the performance and value sweet spot. Yet this configuration continues to command an average price of around €400 in Germany. That figure represents a staggering 432% increase compared to pricing in July of last year—the largest percentage jump across the DDR5 category.

As a result, while January’s data shows that the pace of price hikes has slowed dramatically, the broader crisis is far from resolved. Stabilization at elevated levels offers little immediate comfort to consumers and system builders who have already absorbed the brunt of the increases.

A Pause, Not a Recovery

For now, the German market suggests that the worst of the short-term escalation may have passed. However, analysts caution against reading too much into a single month of relative calm. The underlying supply constraints that drove prices upward remain largely unresolved, and any renewed disruption could quickly reverse the trend.