For several weeks now, industry insiders have been warning about a long stretch of DRAM and NAND shortages. Those concerns are no longer just speculation. SK Hynix, one of the world’s biggest memory manufacturers, has delivered a bleak outlook of its own: shortages of mainstream memory—the kind used in everyday devices—are expected to last until 2028.

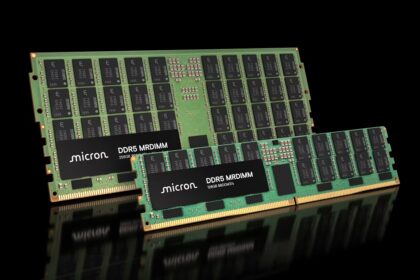

According to the company’s latest financial report, supply will be unable to keep pace with demand for widely used memory types, such as DDR4, DDR5, LPDDR5X, and even graphics memory like GDDR6 and GDDR7, over the next few years. SK Hynix isn’t alone in this shift. Both Samsung and Micron have hinted that the consumer memory market, which they once focused on, is no longer at the top of their priority list.

Once again, AI is driving the change

The reason is hardly a surprise: artificial intelligence. SK Hynix has chosen to concentrate almost entirely on producing high-end, high-margin memory products, particularly HBM (High Bandwidth Memory) and newer SOCAMM modules, which are critical for AI servers and data-centre GPUs.

The report makes it clear that this marks a major strategic shift. Supplies of standard consumer memory are steadily shrinking, and the company has no plans to expand capacity for these lower-margin products. Even as SK Hynix installs new EUV lithography equipment, those resources will be used exclusively for HBM production and advanced AI-focused solutions.

The result is a market where data centres and server hardware receive top priority, while PCs, game consoles, and smartphones compete for what remains. For consumers, this likely means higher prices. Unlike past memory cycles, where manufacturers boosted output to stabilise costs, this time the approach is different: scarcity isn’t being fixed—it’s being monetised.