Nvidia has introduced stricter purchasing conditions for its H200 artificial intelligence processors sold to customers in China, requiring full advance payment as regulatory uncertainty continues to cloud approvals for imports, according to sources cited by Reuters.

Under the revised terms, Chinese buyers must pay 100 per cent of an order’s value at the time of purchase, with no option to alter configurations once the order is placed. I

n limited circumstances, Nvidia may accept commercial insurance policies or asset-backed collateral as an alternative to cash; however, the overall framework represents a significant tightening compared to earlier arrangements, which sometimes allowed for partial deposits.

The move reflects Nvidia’s efforts to manage risk as Chinese authorities continue to evaluate whether and under what conditions the H200 can be imported. While approval is widely expected in early 2026, regulators are projected to limit access to selected commercial customers and impose additional compliance requirements.

Purchases by military entities, sensitive government agencies, operators of critical infrastructure, and state-owned enterprises are expected to remain prohibited due to security concerns.

Regulators have also reportedly instructed some Chinese technology firms to temporarily suspend orders while officials determine how many domestically produced AI accelerators must be purchased alongside each imported H200 unit.

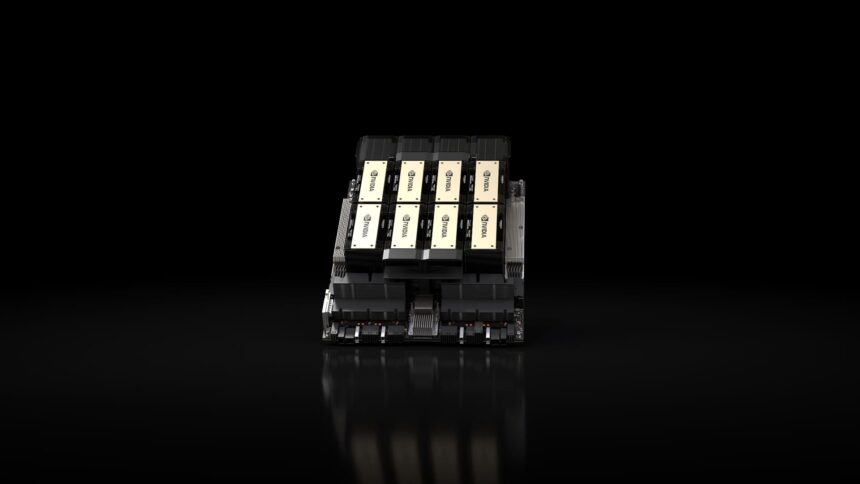

Despite the tougher sales conditions, demand for Nvidia’s latest data-centre processor remains strong in China. Local technology companies have collectively placed orders exceeding two million H200 chips, each priced at approximately $27,000. That volume far surpasses Nvidia’s current available inventory, estimated at around 700,000 units.

Nvidia plans to fulfil an initial portion of Chinese orders from existing stock, with first shipments expected to arrive before the Lunar New Year in mid-February. Supplying the remaining demand—more than 1.3 million additional units—will require new production runs.

To meet that need, Nvidia will have to allocate manufacturing capacity at TSMC, produce the chips, and complete advanced packaging using the CoWoS-S process, a timeline that typically exceeds three months. As a result, further deliveries to Chinese customers are not expected until the second quarter at the earliest.

The stricter payment terms underscore how geopolitical and regulatory pressures are reshaping the global AI hardware market, even as demand for high-performance processors remains strong.