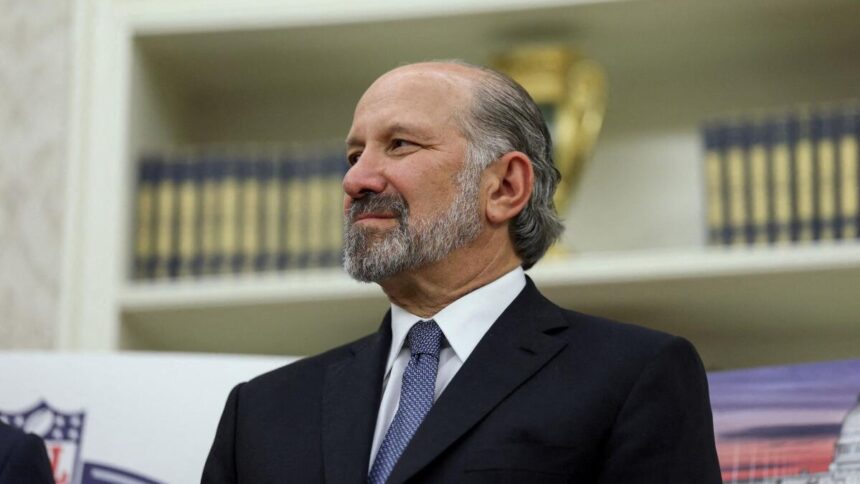

Micron Technology has officially begun construction on a massive new semiconductor manufacturing facility in Syracuse, New York, marking one of the largest industrial investments in U.S. history. The $100 billion project broke ground on January 16, with Howard Lutnick, the U.S. Secretary of Commerce, attending the ceremony as an honorary participant.

While the event itself carried a celebratory tone, Lutnick’s remarks shortly afterwards underscored a far tougher message for the global memory industry. Speaking to reporters, he made clear that companies producing memory chips outside the United States could soon face severe trade consequences.

“Everyone who wants to build memory has two choices: they can pay a 100% tariff, or they can build in America,” Lutnick said, describing the approach as a deliberate form of industrial policy.

Although no companies were named, the warning was widely interpreted as directed at the dominant non-U.S. memory manufacturers, Samsung Electronics and SK Hynix. Alongside Micron, these three firms control the overwhelming majority of global DRAM production.

Strategic Shift Toward Domestic Memory Manufacturing

Micron, the only major U.S.-based memory producer, has increasingly aligned itself with Washington’s push to reshore critical semiconductor manufacturing. The Syracuse facility is expected to play a central role in strengthening domestic supply chains amid intensifying global memory shortages.

Those shortages are being driven largely by surging demand for high-bandwidth memory (HBM), a specialised form of DRAM used in advanced artificial intelligence accelerators. Only Micron, Samsung, and SK Hynix currently have the technical capability to manufacture HBM at scale. These chips are essential components in AI processors produced by companies such as NVIDIA and AMD.

The profitability of long-term AI supply contracts has reshaped priorities across the memory industry. Micron confirmed late last year that it would step away from parts of the consumer RAM market in order to focus more heavily on AI-related demand, a move that further constrained supply for traditional consumer electronics.

Rising Prices and Market Pressure

With manufacturers prioritising HBM and enterprise contracts, less capacity remains for consumer memory used in PCs, smartphones, and other electronics. Prices for DRAM and related components have climbed sharply, and industry analysts widely expect elevated pricing to persist.

Lutnick’s remarks suggest that U.S. policy may soon accelerate these trends by applying direct pressure on foreign manufacturers to localise production. If enacted, a 100% tariff would dramatically alter the economics of importing memory into the United States, effectively forcing companies to choose between building domestic facilities or surrendering access to one of the world’s most lucrative markets.

As construction begins in New York, Micron’s expansion signals a broader shift in how governments are treating memory chips—not just as commercial products, but as strategic assets at the center of economic security, technological leadership, and the global AI race.