What began as a bold bet on artificial intelligence has evolved into one of Microsoft’s most consequential partnerships. The alliance between Microsoft and OpenAI is no longer just about experimentation or future potential—it has become a core driver of the company’s financial performance and long-term strategy.

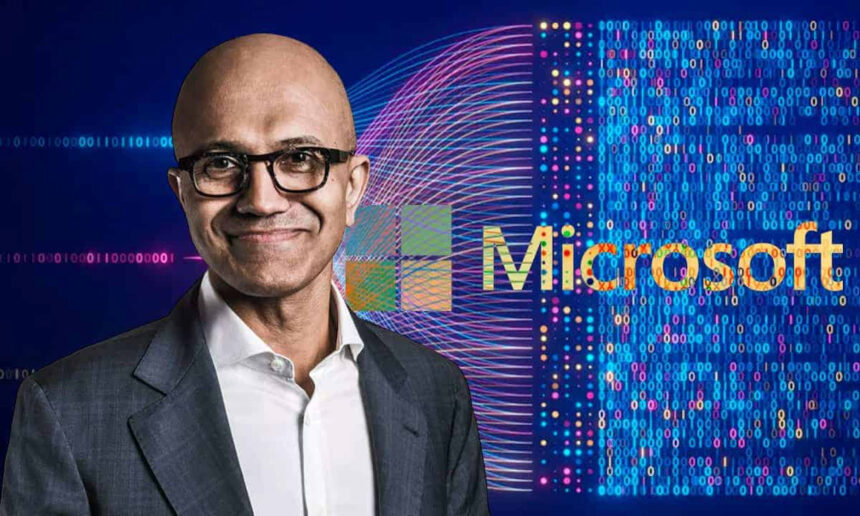

This shift was made clear during Microsoft’s presentation of second-quarter results for fiscal year 2026, where CEO Satya Nadella emphasised that the company is not only competing in AI but is also actively building the infrastructure that defines its limits.

The results underline both the scale of the opportunity and the strain it places on Microsoft’s operations. Quarterly revenue reached $81.3 billion, surpassing market expectations.

However, investor reaction has been measured, reflecting concerns about the immense capital required to sustain the rapid global expansion of AI-focused infrastructure.

AI Demand Creates Record Cloud Backlog

One of the most notable figures disclosed was the dramatic rise in Microsoft’s cloud backlog—the value of contracted services yet to be delivered. This figure has grown 110% year over year, reaching approximately $625 billion. The surge reflects demand that has outpaced Microsoft’s current data center capacity, forcing the company to carefully allocate computing resources to avoid bottlenecks.

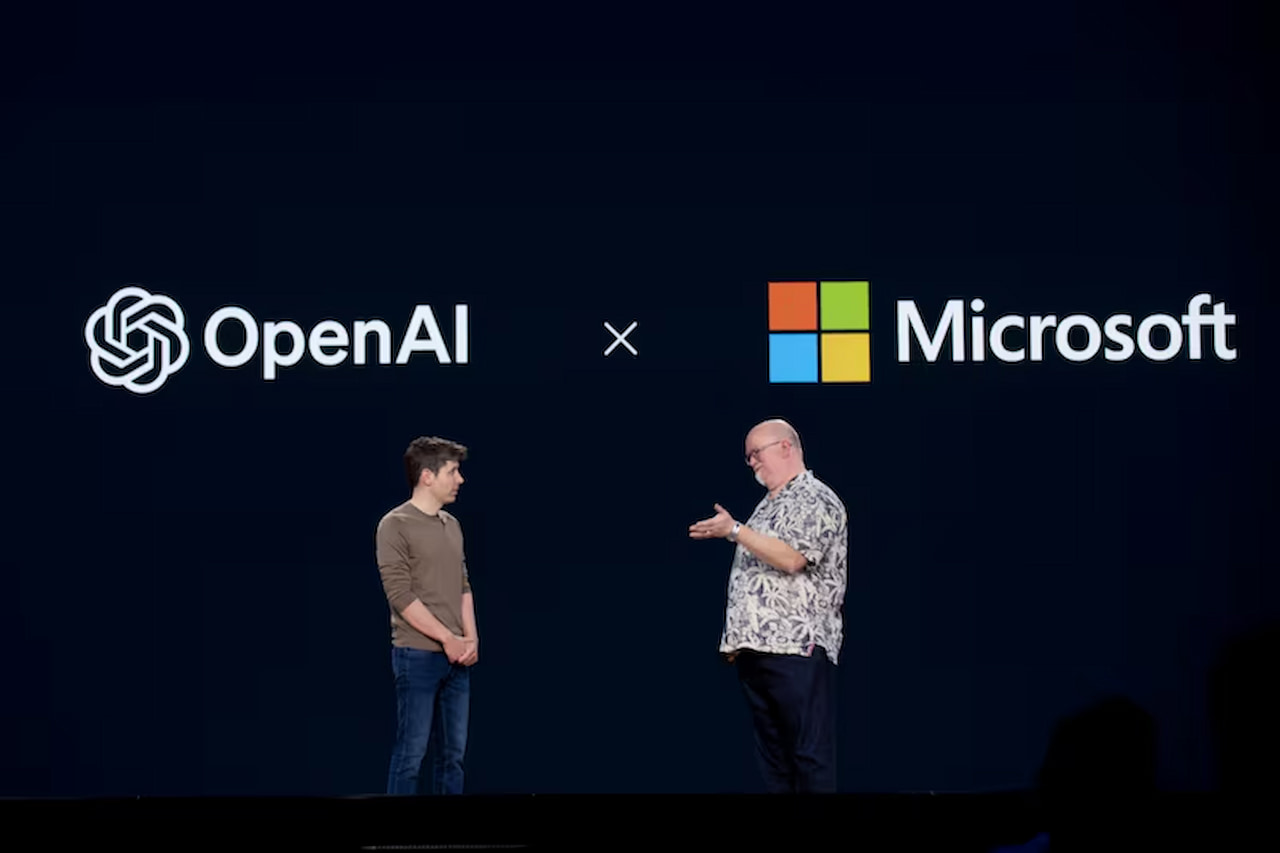

A significant portion of this backlog is tied directly to OpenAI. Roughly 45% of the largest cloud contracts are linked to OpenAI workloads, highlighting how central ChatGPT and related services have become to Azure’s growth. The relationship has effectively positioned OpenAI as Microsoft’s anchor client in the AI era, while Azure serves as the backbone enabling OpenAI’s continued model development and enterprise adoption.

This mutual dependence has strengthened Microsoft’s competitive position against rivals, but it has also increased operational complexity as demand accelerates faster than physical infrastructure can be deployed.

Infrastructure Limits Slow Revenue Recognition

Despite its financial strength, Microsoft faces constraints that money alone cannot solve quickly. Shortages in data center capacity, power availability, and advanced hardware such as GPUs have become limiting factors. These challenges explain why revenue growth has not kept pace with the explosive rise in orders.

Chief Financial Officer Amy Hood noted that scaling AI infrastructure is as much a logistical challenge as a financial one. Building new data centers, securing power, and sourcing specialized chips take time. As a result, there is an inherent delay between signing contracts and recognising revenue, since Microsoft can only bill for services that are fully operational.

This has forced difficult prioritization decisions. The company must balance allocating hardware to OpenAI’s research and model training needs against serving existing Azure customers who are already in line. In the current environment, success is increasingly defined by how quickly Microsoft can build and activate what executives describe as “intelligence factories.”

OpenAI’s Restructuring Boosts Microsoft’s Bottom Line

Another key development influencing Microsoft’s financials is OpenAI’s transition to a for-profit structure. This change has enabled OpenAI to raise capital more flexibly and expand commercial offerings, directly benefiting Microsoft as its primary backer.

Microsoft reported that this revised arrangement contributed approximately $7.6 billion to net income, a return that helps justify the multibillion-dollar investments made over recent years. While detailed terms remain undisclosed, industry estimates suggest Microsoft receives around 20% of OpenAI’s revenue, giving it a privileged position as ChatGPT gains traction across enterprise markets.

Nadella’s vision extends beyond Azure alone. Microsoft is working to integrate AI across its broader portfolio—including Microsoft 365, GitHub, and Copilot-branded services—while avoiding internal competition. The objective is to maximize total market value by embedding AI at multiple points across customer workflows.

A High-Stakes Balance Going Forward

Looking ahead, Microsoft faces a delicate balancing act. Continued leadership in AI will require sustained, large-scale investment in infrastructure at a time when competitors are racing to secure their own capacity. Converting the massive backlog into realized revenue will be critical to proving that generative AI represents a durable foundation for modern computing, rather than a short-lived surge.

For Microsoft, the partnership with OpenAI has already reshaped its business. The challenge now lies in execution—turning unprecedented demand into operational scale, financial returns, and long-term dominance in an industry being rapidly redefined by artificial intelligence.