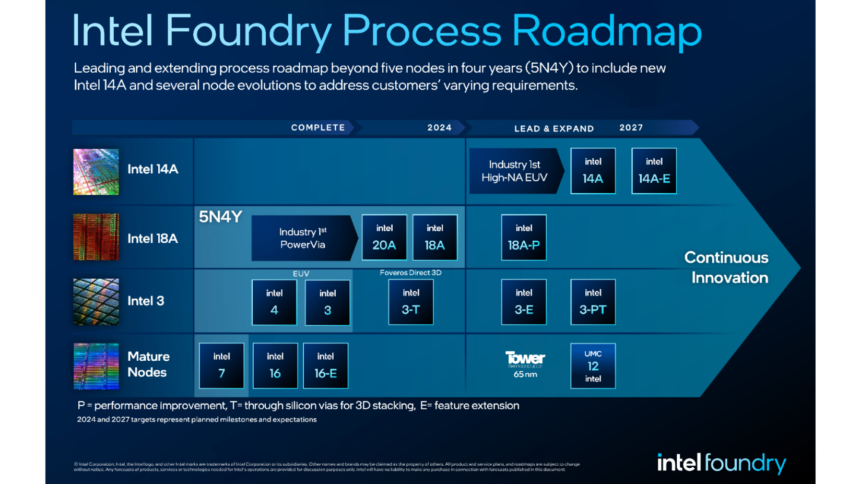

While Intel used this year’s CES to spotlight its upcoming Core Ultra 3-series “Panther Lake” processors, the company’s leadership also took the opportunity to address a longer-term priority: the progress of its next-generation 14A manufacturing process.

Intel Chief Executive Lip-Bu Tan spoke publicly about the 1.4nm-class node, emphasizing that development is advancing as planned. In a video released through Intel News on X, Tan said the company is “going big” on 14A and highlighted expectations of strong momentum in yields and intellectual property readiness aimed at serving customers.

Intel currently expects 14A to be ready for volume production in 2027. Early versions of the process design kit are scheduled to be shared with external customers as soon as this year, a timeline that underscores the company’s push to position Intel Foundry as a viable alternative to established contract chipmakers. Tan’s reference to “the customer” during his remarks has been interpreted by some industry observers as a sign that Intel may already have at least one external client lined up for the node.

Building on 18A, but with higher stakes

The 14A process builds directly on lessons learned from Intel’s 18A technology, which is being used to manufacture the compute tile for Panther Lake processors. The 18A node marked Intel’s first deployment of RibbonFET gate-all-around transistors and PowerVia backside power delivery. While those innovations are central to Intel’s internal roadmap, 14A is expected to take them further.

According to Intel’s disclosures, 14A will introduce second-generation RibbonFET transistors, an updated backside power delivery system known as PowerDirect, and so-called Turbo Cells. These enhancements are designed to improve power delivery efficiency, reduce voltage fluctuations, and boost performance by optimising critical timing paths without significantly increasing power consumption or die area.

External customers remain the key challenge

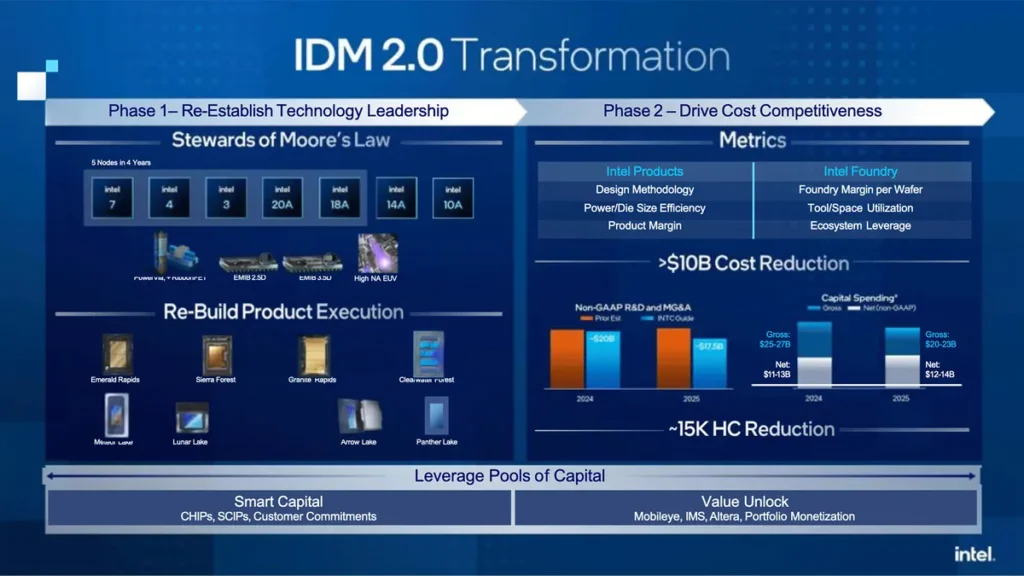

Beyond technical milestones, 14A holds strategic importance due to Intel’s broader foundry ambitions. With 18A, Intel has struggled to attract major third-party customers that would require high production volumes. While the node will be used internally and by organisations such as Microsoft and the U.S. Department of Defence, Intel itself remains the primary volume customer.

For 14A, Intel is aiming to change that dynamic by securing at least one large external client. Doing so would help justify the substantial investment required to develop such an advanced process and would be a crucial step toward making Intel Foundry financially sustainable.

However, there is a complication. Intel’s current capital expenditure plans do not include additional 14A manufacturing capacity dedicated to third-party customers. Winning a major contract from a company such as Apple, AMD, Nvidia, or Qualcomm would require new investments, potentially delaying Intel Foundry’s path to breakeven.

That concern was addressed last November by John Pitzer, Intel’s corporate vice president of corporate planning and investor relations, during remarks at the RBC Capital Markets Global Technology, Internet, Media and Telecommunications Conference.

Pitzer noted that landing a major 14A customer would likely push out profitability timelines, as capacity investments would need to be made well before revenue materialises. He added, however, that such a development would also serve as proof that Intel can successfully operate as an external foundry.

As Intel balances near-term product launches with long-term manufacturing bets, the success of 14A may ultimately hinge not just on technical execution, but on whether the company can convince outside customers to commit at a meaningful scale.