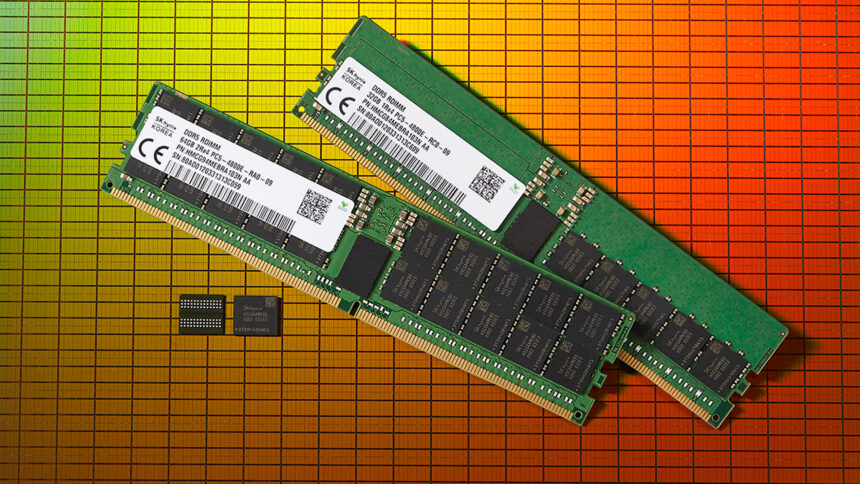

A mounting shortage of DRAM is rapidly reshaping the technology landscape, pushing memory prices to historic highs and threatening to raise costs across nearly every category of consumer electronics. The crisis, driven largely by explosive demand from artificial intelligence datacenters, has already rattled the PC market and is expected to intensify through 2026.

For years, the DRAM industry—dominated by SK hynix, Samsung, and Micron—remained predictable. Manufacturers supplied a steady flow of chips to PC builders, laptop producers, and phone makers, with prices kept well within reach for consumers. That stability collapsed when the AI boom triggered an unprecedented scramble for high-speed memory.

Major AI firms, backed by massive investment capital, began securing vast quantities of DRAM and, more specifically, High Bandwidth Memory (HBM), a variant crucial for training and running large-scale AI models. As the world’s three primary DRAM suppliers shifted production toward these lucrative enterprise contracts, consumer-level hardware was left with dwindling supply.

The shortage has pushed DDR5 RAM—once a few hundred dollars—into price brackets approaching four figures. Stockouts and accelerated buying have only intensified the crunch.

Micron’s Exit From Consumer RAM Adds Fuel to the Fire

The crisis escalated further when Micron confirmed it will withdraw from the consumer market in early 2026, discontinuing shipments of its Crucial-branded memory and storage. The decision leaves Samsung and SK hynix as the only significant suppliers of consumer DRAM.

Micron cited surging demand from enterprises and AI as the deciding factor, explaining that shifting resources toward strategic customers was necessary to meet the accelerating data centre requirements. While the company expressed appreciation for longtime Crucial users, the move underscores the widening gap between consumer needs and industry priorities.

Samsung has already acknowledged plans to shift more production toward DDR5 to capitalise on soaring prices, while SK hynix intends to expand DRAM manufacturing in 2026—though most of that output is expected to feed enterprise and AI clients first.

Impact Spreads Beyond PC Builders

Although PC components have seen the steepest price jumps, the implications extend much further. Any device relying on DRAM—including laptops, tablets, smartphones, televisions, handheld gaming systems, cars, cameras, and smartwatches—is now exposed to rising production costs.

TrendForce reports that Dell may raise PC prices by 15–20% as early as December 2025, while Lenovo has warned customers that its current pricing guidelines will expire at the start of 2026. HP has also signaled potential increases in the second half of the year if supply does not improve.

The situation is compounded by a parallel squeeze in NAND flash supply. Demand for NAND wafers surged up to 60% in November 2025, driven by enterprise SSD orders and AI applications, further reducing the availability of components used in consumer storage devices.

No Immediate Relief in Sight

Industry experts caution that the price surge may be merely the beginning. Team Group general manager Gerry Chen recently noted that December DRAM contract pricing climbed 80–100%, indicating the start of a “multiyear memory upcycle.” Chen expects conditions to deteriorate further once the inventory purchased before the spike is depleted.

Building new memory fabrication plants is an obvious solution—but not a quick one. Facilities take years to construct and require multibillion-dollar investments. Micron is currently the only major supplier to announce a new DRAM fab, a $10 billion project in Japan that is not expected to produce chips until late 2028.

Absent new production capacity, the only other potential relief would come from a slowdown in AI spending. If investment in large-scale AI projects cools, demand for HBM and DRAM could fall sharply, leaving an oversupply that may pull prices back down. However, such a downturn would come with significant economic consequences across global markets.

For now, analysts suggest consumers should brace for continued volatility. With AI still expanding and memory production redirected toward enterprise buyers, the DRAM shortage shows every sign of defining the next several years of technology pricing.