Intel has acknowledged once again that it is unable to meet full market demand for several of its most important client and data center processors, citing constrained wafer supply as the primary bottleneck.

Speaking this week at the UBS Global Technology and AI Conference 2025, company executives made it clear that stronger demand—particularly for newer architectures—is being held back not by lack of customers, but by limited manufacturing capacity at key points in the supply chain.

At the center of the issue are Intel’s Core Ultra 200-series processors, including Arrow Lake and Lunar Lake, as well as its latest server-class Xeon 6 “Granite Rapids” CPUs.

“If we had more Lunar Lake wafers, we would be selling more Lunar Lake. If we had more Arrow Lake wafers, we would be selling more Arrow Lake,”

said John Pitzer, Intel’s Corporate Vice President of Corporate Planning and Investor Relations.

“I think we feel pretty good about where we are in the AI PC transition.”

Strong Demand, Limited Supply

Although overall PC market growth has slowed compared to earlier cycles, Intel says demand for modern client systems—especially those marketed as AI PCs—remains robust. Enterprises and consumers alike are upgrading hardware to support new AI-driven workloads, creating sustained pressure on Intel’s latest product lines.

However, Intel’s ability to meet that demand is limited by its reliance on TSMC for critical components. The logic tiles used in Arrow Lake and Lunar Lake CPUs are fabricated on TSMC’s N3B (3nm-class) process, one of the most advanced nodes in the world. Final packaging is handled internally by Intel, but wafer availability is determined by allocations from TSMC.

According to Intel, those allocations turned out to be too conservative when orders were placed—leaving the company short of supply now that demand has exceeded expectations.

Why More Capacity Isn’t Coming Quickly

TSMC’s 3nm production lines are among the most heavily utilised in the semiconductor industry, serving multiple high-profile customers. As a result, Intel cannot simply request more capacity on short notice.

While Intel expects incremental improvements in Arrow Lake and Lunar Lake supply to begin in the fourth quarter and beyond, executives stopped short of saying that backlog demand will be fully cleared anytime soon.

One silver lining is memory availability. Intel has confirmed that it has secured a sufficient supply of LPDDR5X for Lunar Lake processors, which include on-package memory. This means production costs for those CPUs are unlikely to rise in the near term—despite turbulent conditions in the broader DRAM market.

Potential Price Pressure Ahead

Even with a stable LPDDR5X supply, Intel faces a difficult pricing environment. DRAM prices remain elevated, and shortages across the semiconductor ecosystem persist. While Intel has not announced any immediate price increases for client CPUs, executives acknowledged that long-term pricing strategy remains uncertain if supply constraints continue.

Industry observers are watching closely to see whether Intel will eventually raise prices on Core Ultra processors if demand continues to outpace supply throughout 2025 and 2026.

Server Market Constraints Extend Beyond Client CPUs

Intel’s supply challenges are not limited to consumer and commercial PCs. The company also confirmed tight capacity for its Xeon 6 “Granite Rapids” processors—its latest-generation server CPUs aimed at high-performance and AI-focused data centers.

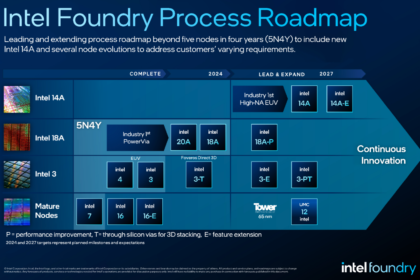

Granite Rapids chips are built on Intel 3, one of Intel’s newer manufacturing technologies. However, the bulk of Intel’s internal fabrication capacity is still concentrated on 10nm-class processes, including:

- 10nm SuperFin

- Intel 7 (formerly 10nm Enhanced SuperFin)

These older nodes rely on DUV lithography, whereas newer Intel 3 production depends much more heavily on EUV tools. Despite billions of dollars invested in upgrading fabs with next-generation equipment—such as ASML’s EUV systems—Intel’s advanced-node capacity remains limited.

“The vast majority of our capacity today is still on Intel 7, 10nm, and that is why we are tightest there,”

Pitzer explained.

“Quite frankly, if we had more Granite Rapids wafers, we would be selling more Granite Rapids.”

Intel says it is encouraged by the early ramp of Granite Rapids and believes initial deployments are progressing well, even if supply cannot yet satisfy full market demand.

The current situation highlights a broader transition underway at Intel. While the company is aggressively investing to modernize its fabs and expand advanced-node production, it remains highly dependent on external foundries for leading-edge client chiplets—at least for the near future.

Until Intel’s internal process roadmap fully matures and more capacity comes online, the company appears set to operate in a demand-constrained environment, particularly for its most advanced CPUs.

For customers, this could mean continued tight availability of popular Intel processors. For Intel, it underscores the delicate balance between aggressive innovation, conservative capacity planning, and the realities of today’s hyper-competitive semiconductor supply chain.