A bipartisan coalition in the U.S. Senate has introduced the Secure and Feasible Exports of Chips Act of 2025 (SAFE Chips Act), a bill designed to hard-code current export restrictions on advanced AI and high-performance computing processors into federal law for the next 30 months.

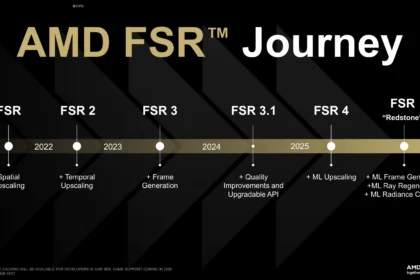

If enacted, the legislation would prevent companies such as Nvidia and AMD from selling any accelerators based on their latest architectures to China and other nations classified as adversaries. Instead, they would be limited to exporting older, performance-capped chips such as Nvidia’s H20 and AMD’s MI308, regardless of advancements in future architectures.

The SAFE Chips Act uses definitions that mirror the technical thresholds established by the U.S. Commerce Department’s ECCN 3A090/4A090 regulations. Any processor that meets or exceeds these thresholds is classified as an advanced device, requiring a restrictive export license. Key performance criteria include:

- Total Processing Performance (TPP) ≥ 4,800

- TPP ≥ 2,400 with performance density (PD) ≥ 1.6

- TPP ≥ 1,600 with PD ≥ 3.2

- DRAM bandwidth ≥ 4,100 GB/s

- Interconnect bandwidth ≥ 1,100 GB/s

- Combined DRAM + interconnect bandwidth ≥ 5,000 GB/s

Processors exceeding these limits—such as Nvidia’s H100, H200, B100, B200, or AMD’s higher-end Instinct accelerators—would be completely off-limits for sale to China, Hong Kong, Macau, Russia, Iran, or North Korea. Consumer-oriented GPUs (e.g., GeForce and Radeon gaming cards) remain exempt as long as they are not listed under ECCN classifications and are not marketed for data-centre use.

Under the new bill, the Commerce Department would be barred from loosening these limits for 30 months, preventing any short-term regulatory adjustments in response to market or geopolitical shifts.

Nvidia and AMD Restricted to Outdated Chinese-Market GPUs

Both Nvidia and AMD already produce export-compliant accelerators tailored for China, including:

- Nvidia H20, L20 PCIe, L2 PCIe

- AMD Instinct MI308

These chips were introduced in 2023 specifically to meet the earliest version of the 3A090 restrictions. However, China’s domestic semiconductor industry has already surpassed these export-limited devices in several performance categories.

For example:

- Huawei Ascend 910C already achieves 780 TFLOPS (FP16/BF16) versus the H20’s 148 TFLOPS.

- Next-generation Ascend 950PR/950DT NPUs are expected to deliver:

- 1 PFLOP FP8

- 2 PFLOPS FP4

- Significant efficiency and scalability improvements

These advancements allow Chinese firms to build AI systems approaching ZetaFLOPS-scale, potentially surpassing what Nvidia is permitted to sell under U.S. restrictions. If SAFE Chips is enacted, the performance gap between U.S. export-limited hardware and Chinese domestic AI processors will widen dramatically.

Nvidia’s Argument: A Total Ban Helps China More Than It Hurts

Nvidia has been lobbying for permission to sell cut-down versions of its newer Blackwell and Hopper H200 accelerators to China, arguing:

- Reduced-performance GPUs still slow China’s progress

Allowing limited exports forces Chinese companies to rely on U.S. standards rather than accelerating domestic ecosystem independence. - Total exclusion accelerates Chinese hardware dominance

Companies like Huawei, Biren, and Moore Threads will fill the vacuum left by U.S. firms, making it harder for Nvidia to re-enter the market later. - Losing China revenue harms U.S. AI leadership

China remains one of the world’s largest markets for AI accelerators. Nvidia contends that cutting off this revenue undermines its ability to invest in R&D and maintain global competitiveness.

If the bill becomes law, Nvidia will be constrained to offering chips that are already obsolete by today’s standards and will appear increasingly outdated through mid-2028, when the 30-month freeze is scheduled to expire.

How the SAFE Chips Act Governs Future Changes

The legislation includes strict oversight mechanisms:

- 30 months after enactment, the Commerce Department may update thresholds—but only with majority approval from the End-User Review Committee.

- Any revisions must be accompanied by a detailed assessment of how the changes could:

- enhance Chinese military capabilities,

- influence cyber operations, or

- affect the global AI balance.

- Congress must receive 30 days’ notice before any modifications are implemented.

This structure is designed to prevent rapid regulatory adjustments and ensure congressional visibility into export-control decisions.

Political Support Behind the Legislation

The bill is sponsored by a bipartisan group:

- Pete Ricketts (R)

- Chris Coons (D)

- Tom Cotton (R)

- Jeanne Shaheen (D)

- Dave McCormick (R)

- Andy Kim (D)

Senator Coons framed the bill as a defining move for national security, stating:

“The rest of the 21st Century will be determined by who wins the AI race, and whether this technology is built on American values of free thought and free markets or the values of the Chinese Communist Party. We cannot give them the technological keys to our future.”

If passed, the SAFE Chips Act would cement a two-tier global AI hardware landscape:

- China progresses with rapidly advancing domestic accelerators

- U.S. firms remain locked to selling outdated, performance-limited hardware overseas

Supporters of the bill see this as essential to safeguarding U.S. technological leadership. Critics warn it may permanently sever American companies from one of the world’s largest AI markets, speeding China’s push toward self-sufficiency.

The legislation sets the stage for one of the most consequential debates in the ongoing geopolitical race to control next-generation computing.